Custom Fintech Solutions

Our Partners

Revolutionize the way you handle financial operations

Software engineering and digital products for:

Digital Banks

Blockchain and Cryptocurrency Platforms

Wealth Management companies

Lending Platforms

Insurtech Companies

Financial Data Analytics Companies

Why us?

Our experience extends across multiple sectors of the industry:

Banking

Insurance

Investment

Compliance

Audit

Our Fintech Services

We specialize in improved customer experiences, regulatory compliance, end-to-end solutions, data management, cloud capabilities, and lowering barriers for new digital players. Navigate digital transformation effectively for lasting success with our engineering teams.

Custom Fintech solutions

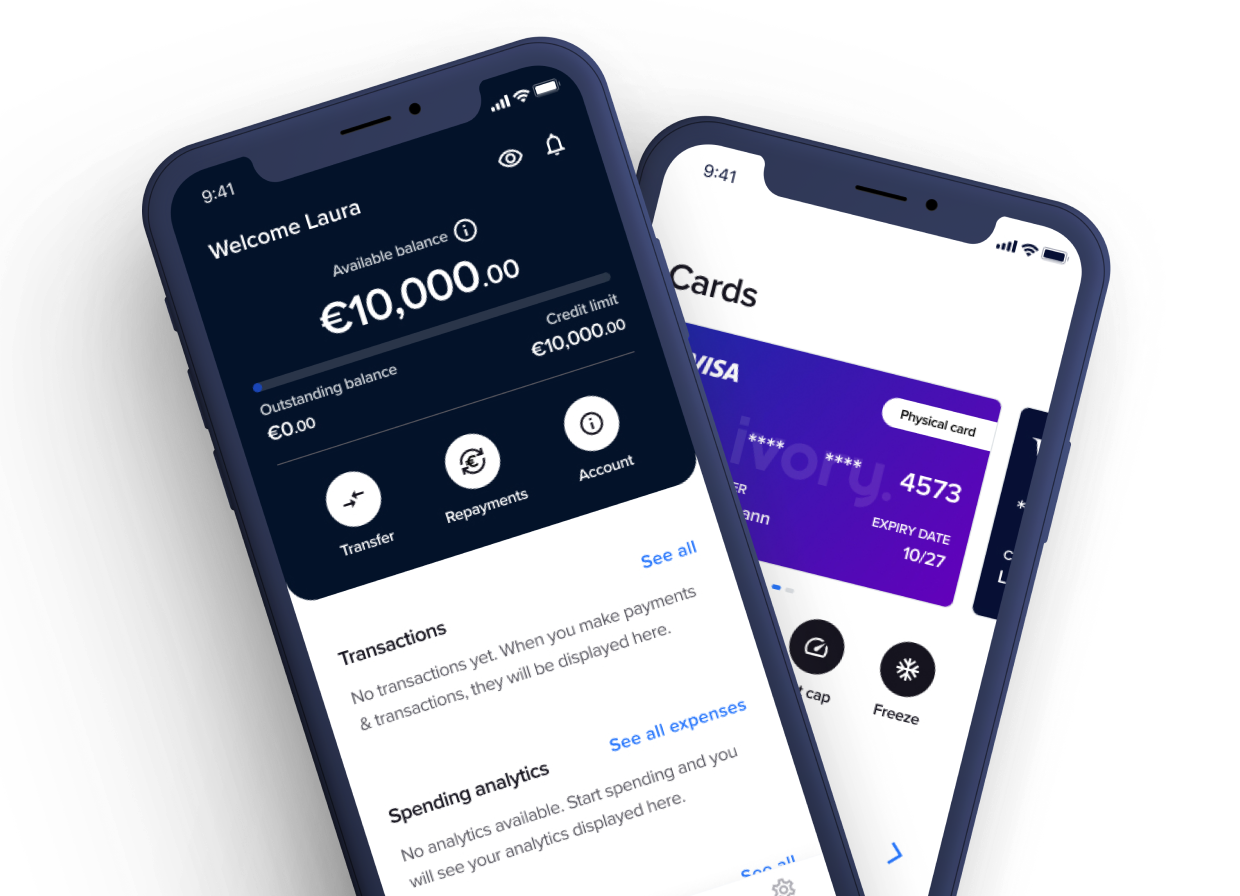

Mobile banking solutions

Payments solutions

Open banking solutions

Generative AI solutions

Blockchain solutions

AI-driven analytics solutions

Cloud-based solutions

Launch a mobile banking application under your own brand using our card management app, which leverages third-party licences, permissions, certifications, and modular microservices.

API Integrations

We are the trusted fintech integrator of some of the best FinTech providers in the world

Security you can trust

Prioritize the security of your financial operations with our cutting-edge solutions, ensuring data integrity, compliance, and resilience against evolving threats.

Insights

Fintech cost optimizations: microservices, AI and the cost curve

How to build Fintech MVPs that pass regulation and scale

AI, capital, and compliance: mapping Fintech startup momentum

Contact us today for a consultation

Put our expertise in digital product development to the test. Join forces with us for a transformative partnership that drives success in the fintech sphere.

Looking for other industries?