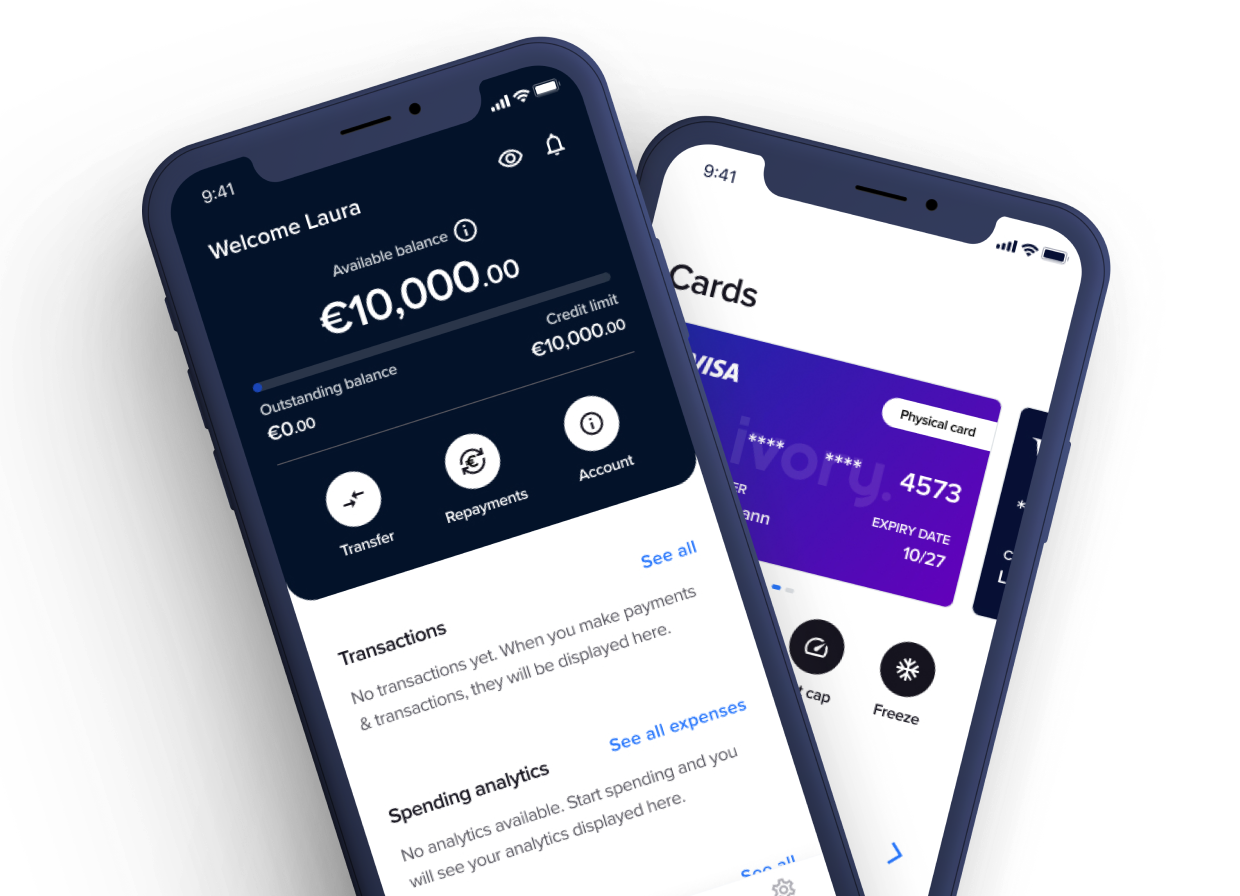

Your Partner in Fintech Evolution

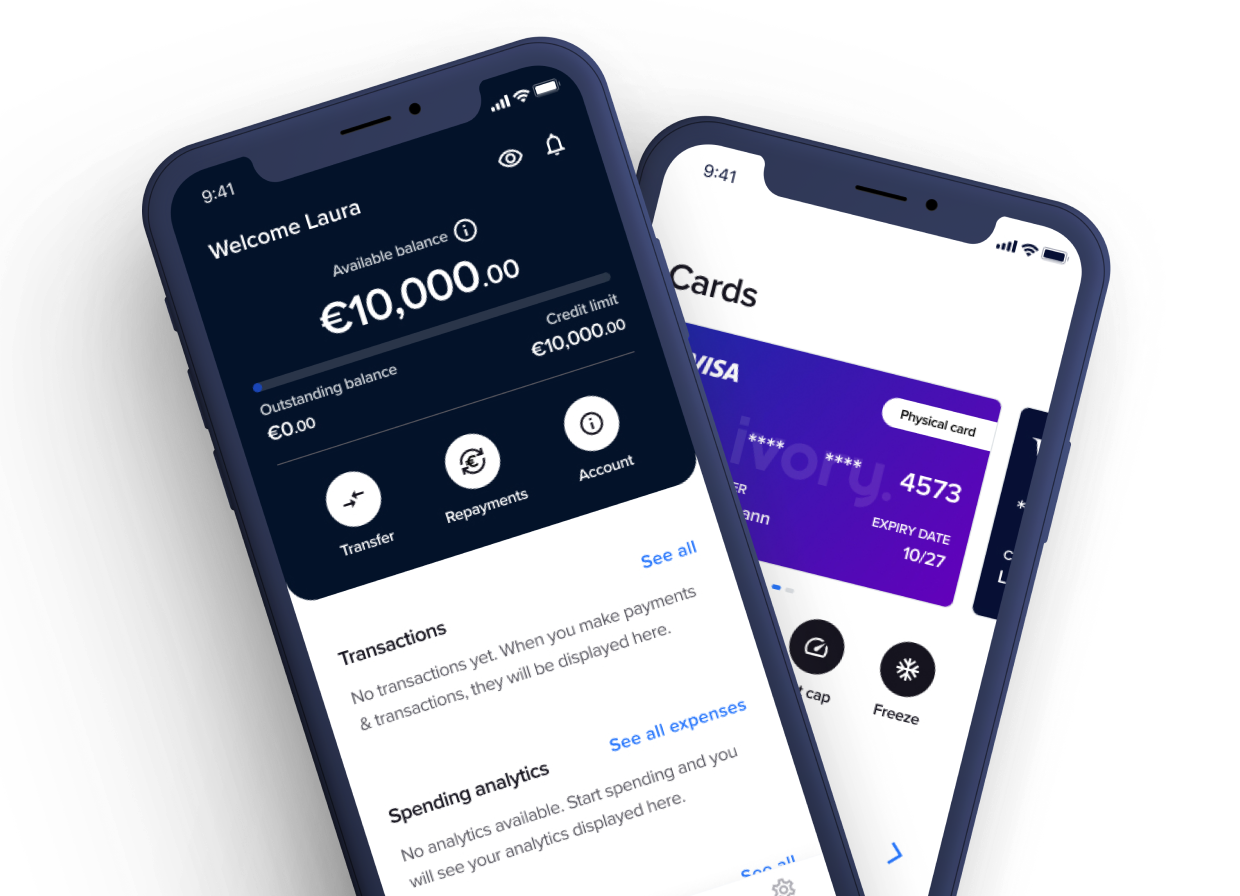

An open-source card management app designed to elevate the experience of your end customers.

Create ambitious customer experiences by blending Ivory's pre-built components with unlimited customization and top tier product development.

Bridging the gap between Digital Banking providers and end customers’ needs.

Capacity

Learning

Solution

Ivory offers a flexible & modular solution, incorporating:

-

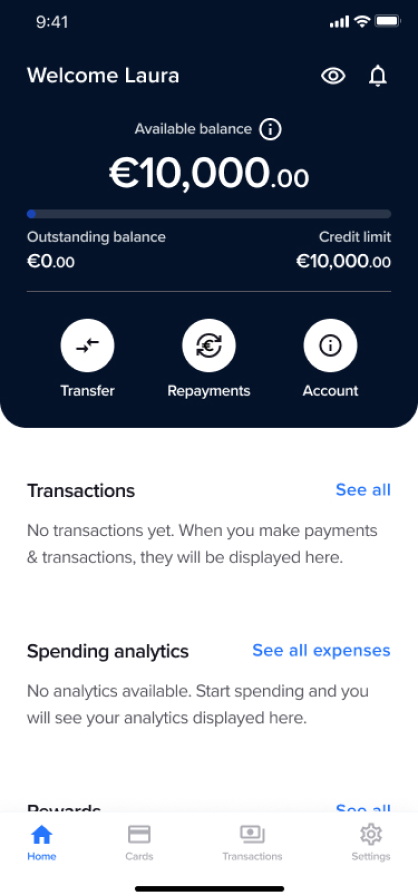

Application Login & Homepage →

-

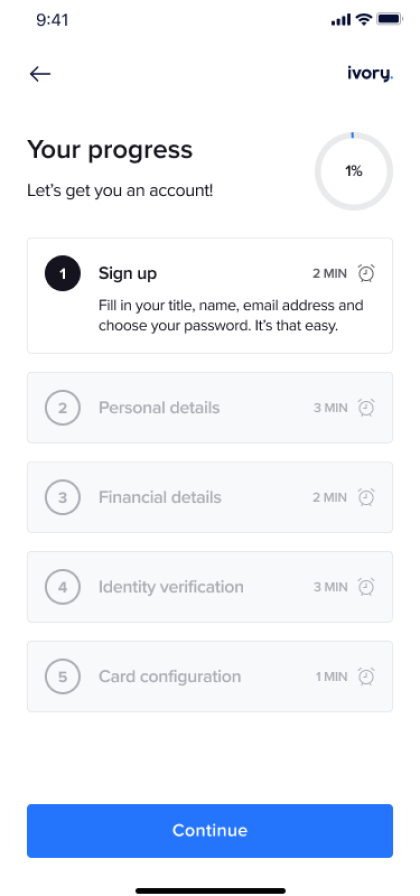

Frictionless onboarding & KYC consumers →

-

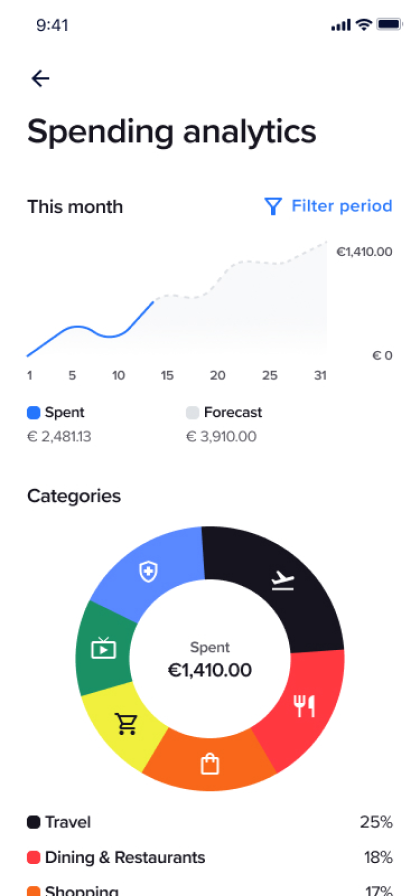

Spending analytics →

-

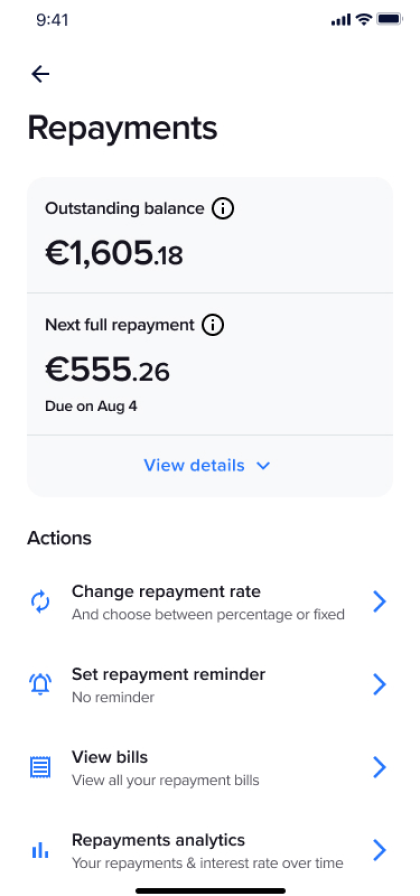

Repayment functionalities →

-

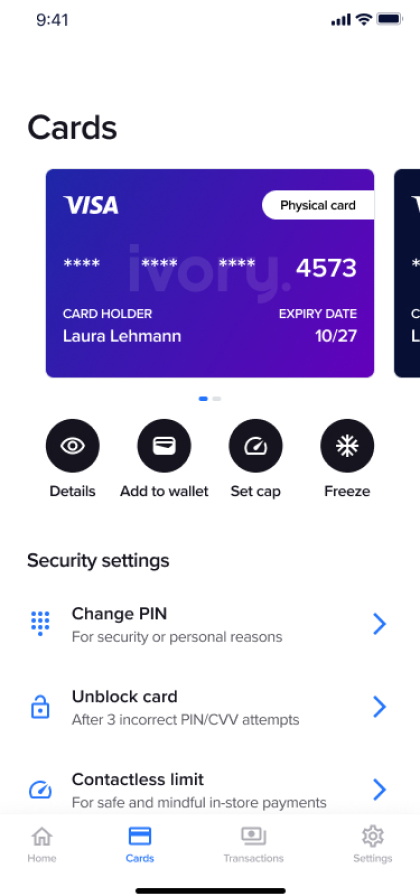

Virtual & physical credit cards details →

-

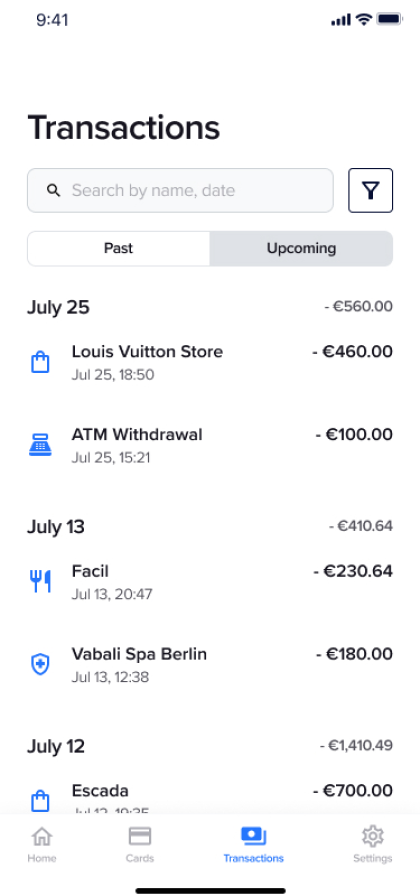

Transactions history →

-

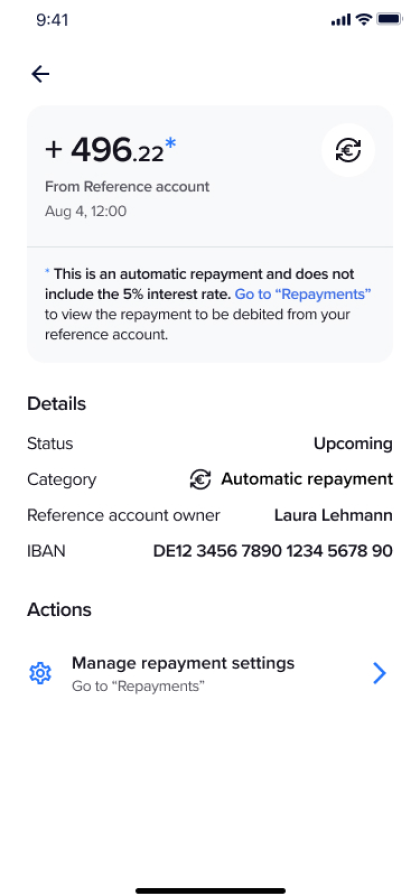

Transaction details →

Don't miss out on building the next-gen banking solution.

Build the personalized experiences consumers want and expect from a banking app

Our front-end capabilities

01. Fintech features

02. Product design

03. Technology stack

-

Statements

-

Loans

-

KYC

-

Transfers

-

Digital assets

-

SMEs

-

Transactions

-

BNPL

-

Lending

-

Digital wallets

-

Crypto

-

Cards

-

Prototypes

-

UX research

-

Wireframes

-

Workshops

-

Concept mapping

-

Design systems

-

Story mapping

-

Style guides

-

Information architecture

-

User journeys

-

Market research

-

Atomic design

-

Visual design

Discover how we can solve your digital banking product needs

Our A's to your Q's

Can I use it for my business?

Yes, it's an open-source card management app.

Ivory proves advantageous for any business that serves customer base, collaborates with numerous partners, employs a considerable workforce, engages with the community, and handles substantial transaction volumes.

Is this a fully compliant solution?

Ivory enforces a comprehensive array of regulatory standards, encompassing KYC/AML, GDPR, PCI DSS, PSD2, FCA, and other essential requirements.