Mobilize Pay: EV‑credit card & cashback fintech platform by Renault

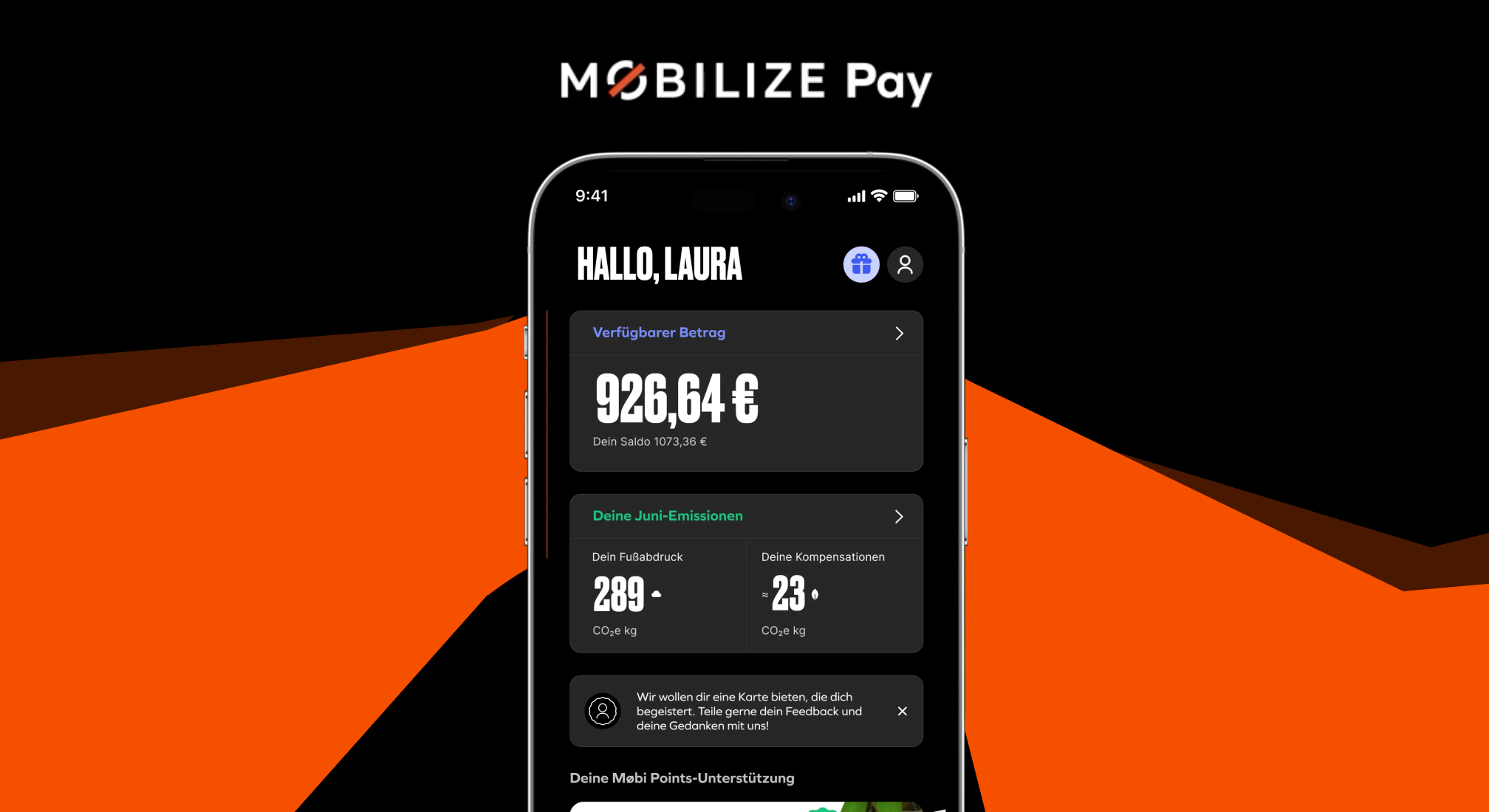

Mobilize Pay was a multifaceted credit card program that extended beyond a mere transactional tool, evolving into a comprehensive ecosystem designed to enhance the electric vehicle (EV) experience. Users could engage in standard credit card transactions, enjoy significant cashback rewards, calculate and offset their carbon footprint and understand their driving behaviors through a driving score while charging their electric vehicles at Renault’s extensive charging station network.

This case study will explore the Mobilize Pay project's initial objectives, technological innovations, and challenges, providing insights into the complexities of innovating at the crossroads of two rapidly evolving industries: automotive and fintech.

Client profile: Renault’s Mobilize Pay launch in electric mobility services

The Mobilize Pay project emerged as a key component of Renault's innovative strategy, launched under the umbrella of Mobilize Financial Services in 2022. This new commercial brand was created as the reference point for all mobility needs related to car use, supporting Mobilize’s vision of "vehicle-as-a-service". Mobilize Pay, along with Mobilize Insurance and Mobilize Lease&Co, signifies a tremendous evolution in the intersection of automotive and financial services industries.

Driven by a bold vision to pivot entirely to electric vehicles by 2029, Renault leveraged Mobilize Pay as a strategic tool to promote EV usage and enhance customer loyalty. This program was intricately linked to Renault's broader business strategy, offering substantial incentives for utilizing their expansive charging infrastructure. Before its public debut, Mobilize Pay underwent rigorous beta-testing in a production environment with a select group of participants. This phase was crucial for refining features like cost optimization for fuel consumption and providing personalized driving tips, all managed directly through the app.

The initiative also strongly emphasized environmental responsibility, allowing users to convert their cashback rewards into "Mobi points." These points could then be donated to environmental projects, directly aiding in reducing users’ carbon footprints and aligning with global sustainability goals.

Our collaboration: building Mobilize Pay app & cashback ecosystem

Our collaboration with Renault on the Mobilize Pay project, which lasted from October 2022 to August 2023, focused intensively on developing the mobile app, backend services connecting to the banking infrastructure, and integrating a robust cashback solution that would incentivize the use of electric vehicles.

We designed this feature to seamlessly integrate with Renault’s extensive network of charging stations, allowing EV owners to receive significant cashback rewards directly through the Mobilize Pay platform when they charge their vehicles. This system not only encouraged more frequent use of Renault’s charging infrastructure but also aimed to enhance the overall ownership experience by offering tangible financial benefits.

Throughout our partnership, we worked collaboratively to ensure the cashback mechanism was user-friendly and effectively integrated with the broader financial services offered through the Mobilize Pay app.

The technical framework for Mobilize Pay was constructed using Flutter for both the mobile application's frontend development and the administration web platform, ensuring a cohesive user experience across devices. For the backend, Java was chosen for its robustness, paired with Google Cloud Platform (GCP) to leverage cloud services that enhance scalability and security.

Members from our technical fintech team were integral to the project, distributed across three mixed teams—each comprising a blend of Thinslices and Mobilize developers. Each team, included Product Owner, Technical Lead, and engineers, and was responsible for different segments of the application.

The Mobilize Pay initiative significantly advanced Renault's goal of enhancing the electric vehicle (EV) ownership experience through the seamless integration of financial services with EV infrastructure. This pioneering project transformed the way customers interacted with Renault's charging network, providing substantial cashback rewards and personalized driving tips. By leveraging data-driven insights and cutting-edge technology, the project incentivized using Renault's charging stations and fostered greater customer loyalty and satisfaction.

Mobilize Pay was a testament to the innovative spirit of Renault and its commitment to sustainable mobility solutions. The project underscored the importance of integrating financial incentives with EV infrastructure to promote greener transportation options. Although the project ended, the lessons learned, and technological breakthroughs continue to influence Renault's approach to electric vehicles and financial services, paving the way for future advancements in the intersection of these dynamic industries.