Banking as a Service vs. Embedded Finance - Differences and Benefits

Navigating the landscape of financial technologies can be overwhelming, especially when terms like Banking as a Service (BaaS) and embedded finance are introduced. While both aim to enhance financial services integration, they serve different purposes and offer unique advantages.

Banking as a Service (BaaS) involves a partnership model where banks open their financial services and infrastructure through APIs. This allows non-bank businesses, like fintech companies, to offer banking products under their brand. BaaS allows third-party providers to build new financial offerings on top of regulated banking infrastructure.

On the other hand, Embedded Finance adopts a slightly different strategy. Financial services are woven directly into the customer journey on non-financial platforms. For example, ride-sharing apps that provide instant insurance or online stores offering point-of-sale financing. The primary aim is to seamlessly blend financial services when consumers need them, enhancing their user experience.

Both BaaS and Embedded Finance represent significant shifts in delivering financial products. While they share some similarities, their differences lie in the target customers and the method of integration, which we will explore in the following sections.

Core Differences Between BaaS and Embedded Finance

Both concepts transform how financial services are delivered and consumed in distinct ways.

1. Primary Focus and Functionality

Banking as a Service (BaaS) is the bridge, enabling non-banking companies to offer banking services seamlessly without building everything from the ground up. It's an enabler that provides the necessary banking infrastructure and compliance.

In contrast, embedded finance focuses on integrating financial services within non-financial platforms, making the experience more intuitive for end-users. Think of it as the 'invisible' financial power behind your favorite apps, enabling you to make transactions without ever leaving the app.

2. Integration and Customization

BaaS prioritizes backend integration with existing banking systems, which allows businesses to weave in their branding and create custom financial products. It can be seen as a toolkit for building an entire financial platform.

On the other hand, embedded finance is often less about deep customization and more about the seamless integration of specific financial actions--like payments or lending--directly onto a non-financial platform with minimal distraction to the user's core experience.

3. User Experience

BaaS typically targets businesses that want to offer comprehensive financial services under their brand. This results in a more holistic customer journey, but it can be resource-intensive to manage and optimize.

Embedded finance enhances user experience by embedding transaction capabilities where users are already active, creating a frictionless and often more satisfying interaction.

4. Compliance and Regulation

Since BaaS involves direct integration with banking systems, it usually comes with a heftier load of regulatory requirements, necessitating robust compliance frameworks.

Embedded finance platforms usually depend on their BaaS partners to handle most of these regulatory and compliance responsibilities, allowing them to focus more on user experience and functionality.

Understanding these core differences helps make an informed decision tailored to your business needs and goals.

Comparing Use Cases: BaaS vs. Embedded Finance

Exploring real-world examples can vividly illustrate the unique advantages of both BaaS and embedded finance. Consider a traditional retailer entering the digital finance space. Through BaaS, the retailer can integrate banking services directly into their operational framework. This means offering white-labeled checking accounts, savings accounts, or even custom financial solutions to their customers without becoming a bank themselves. The result is an enriched customer experience, enhanced loyalty, and new revenue streams.

On the other hand, if the same retailer opts for embedded finance, the focus would shift towards integrating specific financial functionalities within their existing ecosystem. Think about a seamless payment gateway embedded within the retailer’s app. Customers could pay for their purchases, obtain financing, or use buy-now-pay-later options without leaving the retailer’s platform. This approach leverages existing customer touchpoints to provide convenience and ease of use.

Another example can be found in the ride-sharing industry. Companies like Uber or Lyft can use BaaS to offer tailored financial products to their drivers, such as instant payment accounts or savings products. These initiatives can significantly improve financial inclusivity and provide additional incentives for the workforce.

In contrast, embedded finance in these platforms could mean integrating insurance policies directly into the app interface. Drivers could, for example, secure trip-specific insurance coverage at the click of a button, enhancing safety and reducing administrative overhead.

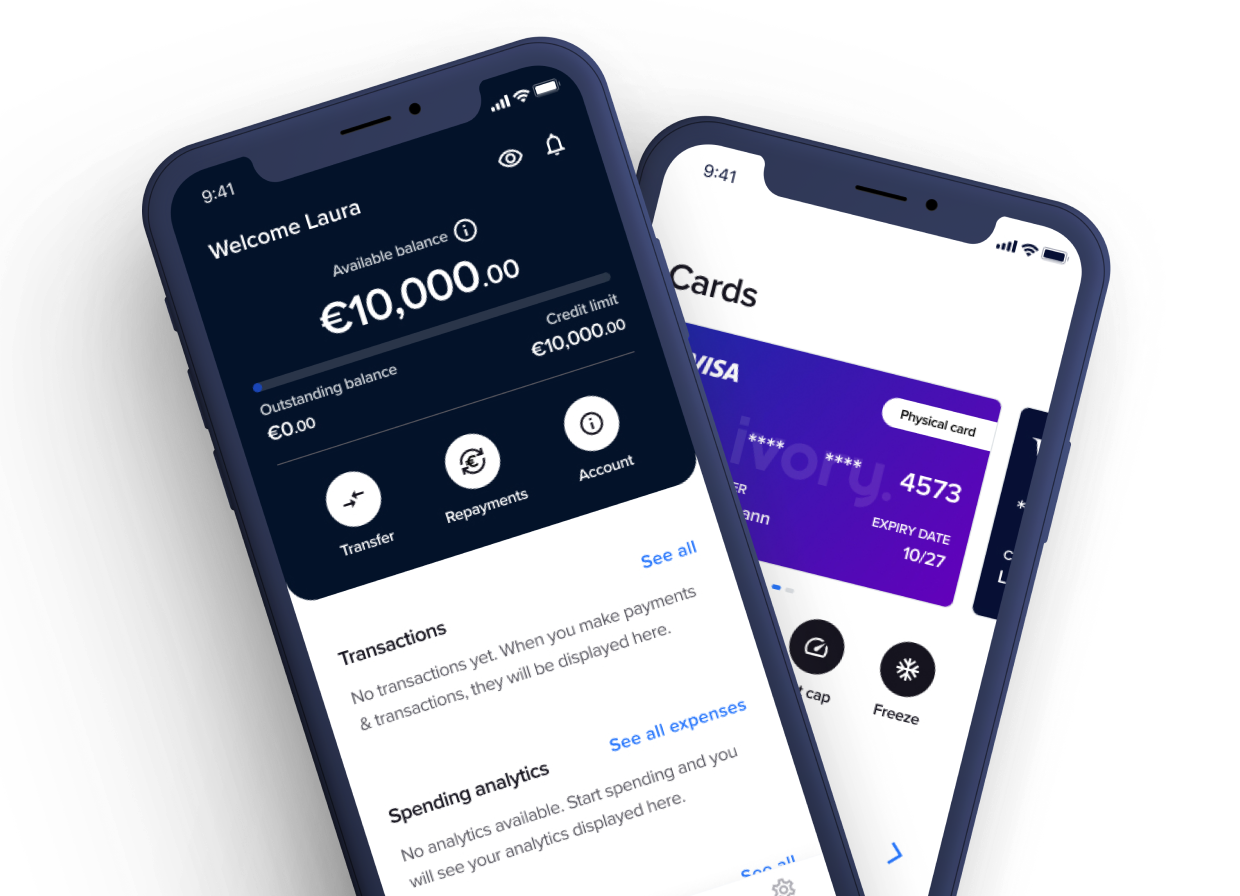

Thinslices' Ivory app exemplifies how businesses can effectively integrate financial services without starting from scratch when considering embedded finance. Ivory is a white-label, customizable platform that empowers companies to offer high-quality financial products through modular, prebuilt components. By streamlining the development process, Ivory enables quicker time-to-market and reduces the complexities associated with financial service integration.

For instance, a retailer looking to introduce a branded payment card or offer point-of-sale financing can leverage Ivory to implement these features seamlessly. Thanks to Ivory's robust architecture, instead of spending months building and testing a new financial system, businesses can deploy a fully functional solution in a matter of weeks. This saves time and resources and ensures that the end-user experience remains consistent and familiar, fostering customer loyalty and satisfaction.

As Sabrina Szabo, Head of Product and Strategic Partnerships at Thinslices, puts it:

Embedded finance isn't just a trend; it's the future of financial services integration. With tools like Ivory, you're equipped to offer unparalleled, streamlined experiences to your users.

This perspective highlights the transformative power of embedded finance, which is no longer just an emerging trend but a critical component in delivering enhanced financial services tailored to customer needs.

Launch a mobile banking application under your brand using our white-label solution.

How to Choose Between BaaS and Embedded Finance

When it comes to choosing between Banking as a Service (BaaS) and embedded finance, several factors need to be considered to make the best choice for your business. Understanding these factors will help align your financial strategy with your overall goals and customer needs.

1. Business Model and Goals

Firstly, assess your business model and what you aim to achieve. If you're a company looking to offer a wide range of financial services, including issuing cards, opening bank accounts, or even launching a full-fledged neobank, BaaS might be the way to go. BaaS provides a comprehensive back-end integration with banks, giving you the flexibility to customize your offerings extensively.

On the other hand, if your primary aim is to enhance your existing platform with financial features like payment processing, lending, or insurance without overhauling your infrastructure, embedded finance can seamlessly integrate these functionalities into your user interface. This allows for a more streamlined and direct user experience.

2. Customer Experience

Consider the user experience you want to deliver. Embedded finance can provide users with a seamless experience by directly integrating financial services into your platform. Your customers can complete financial transactions without leaving your app or website, which is particularly effective for improving customer engagement and retention.

In contrast, BaaS may require users to interact with separate banking interfaces, which could be less seamless but offer more robust and comprehensive banking solutions. Choose the one that aligns better with your customer's journey and expectations.

3. Level of Control and Customization

Evaluate how much control and customization you need over the financial products you plan to offer. BaaS solutions typically provide more control, allowing you to tailor-make products and services to fit your brand and customer needs. With BaaS, you're not confined to the limitations of pre-built solutions, offering significant flexibility.

Embedded finance, while still customizable, might offer less breadth in overall control since it focuses more on front-end integration. This can be a trade-off if you want quick deployment and minimal development overheads.

4. Compliance and Regulatory Requirements

Another crucial consideration is navigating the complex landscape of compliance and regulation. BaaS providers often handle significant portions of the regulatory burden, as they work directly with banks already compliant with financial regulations. This can simplify the process for your business but may require more due diligence to ensure compliance with specific market requirements.

With embedded finance, your responsibility may extend to ensuring that the integrated financial services meet all necessary compliance standards, which can vary depending on your operating regions. This could mean additional overheads and the need for more robust compliance mechanisms.

Integration Challenges: BaaS vs Embedded Finance

Integration is a critical factor that can significantly influence the success of Banking as a Service (BaaS) and embedded finance solutions. While both aim to offer seamless financial services, they each come with unique challenges that businesses must address.

1. Technical Complexity

BaaS often involves integrating with legacy banking systems. Banks have stringent security protocols, making the integration process arduous and time-consuming. Moreover, APIs provided by banks might only sometimes be up-to-date, adding another layer of complexity. Businesses may need to invest in significant development resources to ensure smooth integration.

On the other hand, embedded finance usually aligns more efficiently with modern platforms but brings its technical hurdles. For example, ensuring real-time data flow and maintaining a cohesive user experience across different services can require sophisticated engineering frameworks. The need for constant updates to keep up with the varying functionalities offered by different financial services can also be a challenge.

2. Vendor Coordination

When adopting a BaaS solution, businesses must coordinate with multiple vendors. This could include banks, API providers, and even regulatory bodies. Each vendor may have different onboarding processes and requirements, which can slow down the overall implementation timeline. Effective communication and project management skills are essential to streamline this coordination.

Embedded finance solutions are generally integrated within existing platforms, but the challenge lies in syncing multiple components seamlessly. For instance, if a retailer integrates payment services into its checkout process, it must ensure compatibility with its inventory and customer relationship management (CRM) systems. Ensuring that all these systems communicate effectively can be a mammoth task.

3. Scalability and Maintenance

Another critical challenge is ensuring that your BaaS implementation can scale with your business. As your customer base grows, the demand for the financial services system will increase. This could potentially lead to latency issues, thereby affecting the user experience. Regular maintenance, updates, and performance tuning will be required to keep the system running smoothly.

Embedded finance systems face similar scalability issues. As more services are integrated and the number of transactions increases, the system must be robust enough to handle the load without compromising performance. Regular monitoring and optimization become crucial to maintain service quality.

Addressing these integration challenges requires a thoughtful approach, considering both your business's immediate needs and long-term goals. Utilizing best practices in project management, investing in the right technologies, and maintaining open communication channels with all stakeholders can help mitigate these challenges and set you on the path to success.

Security Considerations in BaaS and Embedded Finance

Whether you opt for BaaS or embedded finance, security is a paramount concern. Both options must comply with stringent data protection and privacy regulations to safeguard customer information. However, the approach and extent of these security measures can vary.

Data Protection and Privacy Regulation

Financial services inherently handle sensitive data. BaaS providers ensure the platform complies with regulations like GDPR, CCPA, and others, depending on the geographic location. They must implement encryption, regular audits, and secure API connections to protect data in transit and at rest. On the other hand, embedded finance requires even more rigorous data governance due to integrating financial services within various applications. Businesses employing embedded finance solutions must ensure every touchpoint is secure and compliant.

Robust Data Governance

Embedded finance involves handling a wider variety of confidential customer data, which requires increased security measures like multi-factor authentication, real-time transaction monitoring, and advanced fraud detection systems to prevent unauthorized access and suspicious activities.

Strong data governance is also in place to ensure that only authorized individuals can access consumer data, which enhances the service's dependability and trustworthiness.

Vendor and Third-Party Risk Management

Both BaaS and embedded finance often involve multiple vendors and third-party services, each of which may present unique security risks. Establishing a comprehensive vendor management strategy is crucial. This includes conducting thorough due diligence during the vendor selection process, continuously monitoring their security practices, and ensuring they adhere to the same stringent security standards.

Incident Response and Recovery Plans

Inevitably, security incidents may occur. Both BaaS and embedded finance providers need to have robust incident response plans. These plans include steps to quickly identify, contain, and mitigate the impact of data breaches or cyberattacks. Additionally, having a structured recovery plan is vital to restoring normal operations with minimal disruption and data loss. Regular drills and updates to these plans can significantly enhance resilience.

While both BaaS and embedded finance strive to provide secure environments, embedded finance's broader scope usually comes with more complex security requirements. Consider these factors as you evaluate the benefits and risks of each option to make an informed decision for your business.

Making the Right Choice for Your Business

Deciding between Banking as a Service (BaaS) and embedded finance refers to your business needs, target audience, and long-term goals. Both options provide unique advantages that can lead to higher engagement, retention, and new revenue streams. The key is understanding what your end-user wants to achieve, which will guide you toward the right financial tools and data they need.

If your business requires a suite of banking capabilities swiftly and efficiently, BaaS is likely the way to go. It allows you to leverage a broad range of services without building the infrastructure from scratch so that you can focus on your core competencies. On the other hand, if creating a seamless, personalized financial experience is paramount, embedded finance may be the better choice. This route lets you integrate financial services directly into your existing products, enhancing user experience and loyalty.

Whether you're leaning towards BaaS or embedded finance, partnering with the right provider is crucial. The ideal partner should offer flexibility, robust compliance measures, and a deep understanding of your industry. They will also help you customize and integrate the solutions that best align with your strategic objectives.

Ultimately, the decision isn't about whether one option is inherently better—it's about what suits your particular business model and customer demands. With a thoughtful approach to understanding and addressing those needs, BaaS and embedded finance present exciting opportunities for growth, innovation, and enhanced customer experiences.

Whether you're looking to enhance your existing platform with embedded finance or launch a new financial product, Ivory has the tools to make it happen—quickly and efficiently.

Request a Demo today to see Ivory in action and explore how it can meet your specific needs. Interested in taking it a step further? Become a Partner with Thinslices and leverage our expertise to innovate and grow together.

Mobile Frontend for Fintech Apps

Our mobile front-end provides a head start in developing your solution, with 80% pre-built components and 20% customization for your fintech app.